Gwinnett County Property Appraiser Search

Property Tax

Search for Property · Tax Sale Excess Funds · Unclaimed Refunds · Update My ... Alerts. Shashikanth Reddy Dhara, Saturday, January 17, 2026. Site/system ...

https://www.gwinnetttaxcommissioner.com/property-taxGwinnett County Courts - Deeds and Land Records

Deeds and Land Records The Superior Court Clerk's duties include recording all Gwinnett County real estate deeds, plats, condominium floor plans, Uniform Commercial Code Filings, General Execution Docket and Lien filings, Military Discharges, Partnerships and Physicians License, providing an index and images of all documents.

https://www.gwinnettcourts.com/deeds-and-land-records/

Tax Commissioner's Office announces new tag office hours ...

Tax Commissioner's Office announces new tag office hours for 2026. Posted: December 8, 2025. Story Link: https://www.gwinnettcounty.com/home ...

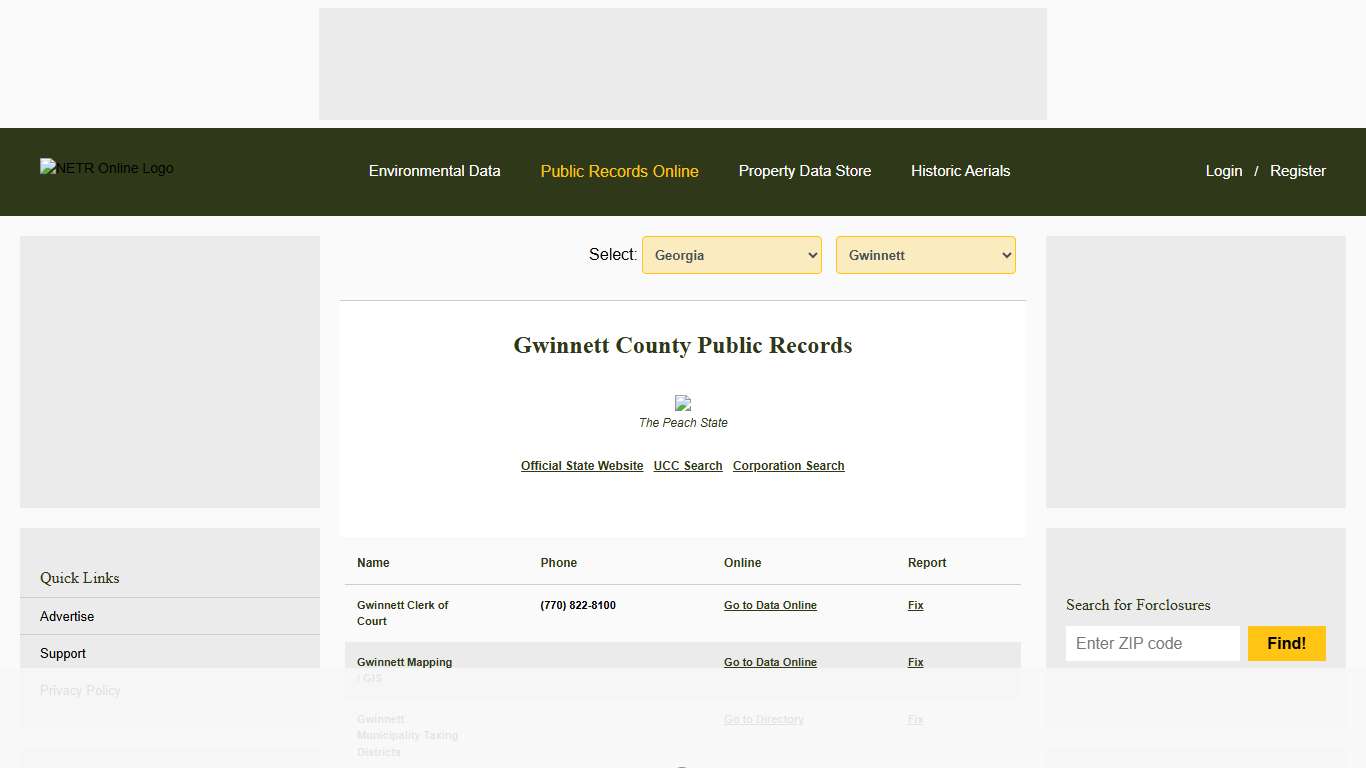

https://www.gwinnettcounty.com/home/stories/viewstory/-/story/tax-commissioners--new-tag-office-hours-2026NETR Online • Gwinnett • Gwinnett Public Records, Search Gwinnett Records, Gwinnett Property Tax, Georgia Property Search, Georgia Assessor

Select: Gwinnett County Public Records The Peach State Gwinnett Clerk of Court (770) 822-8100 Gwinnett Municipality Taxing Districts Gwinnett Tax Commissioner (770) 822-8800 Gwinnett Assessor (770) 822-7200 Gwinnett NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store...

https://publicrecords.netronline.com/state/GA/county/gwinnett

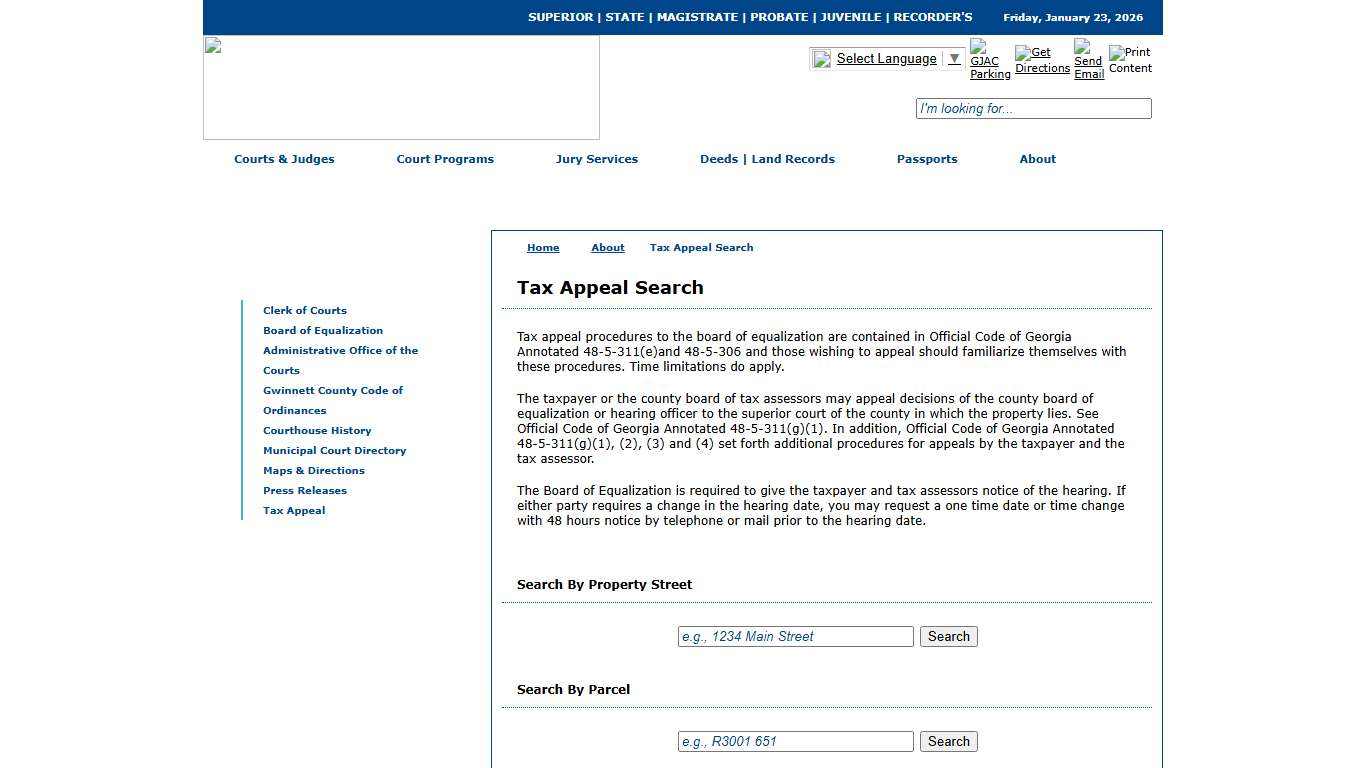

Gwinnett County - About - Tax Appeal Search

Tax Appeal Search Tax appeal procedures to the board of equalization are contained in Official Code of Georgia Annotated 48-5-311(e)and 48-5-306 and those wishing to appeal should familiarize themselves with these procedures. Time limitations do apply. The taxpayer or the county board of tax assessors may appeal decisions of the county board of equalization or hearing officer to the superior court of the county in which the property lies.

https://www.gwinnettcourts.com/about/boe-appeal-search

Gwinnett County Tax Commissioner Home - Gwinnett County Tax Commissioner Gwinnett County Tax Commissioner

Gwinnett County Tax Commissioner Home Denise R. Mitchell, MPA Gwinnett County Tax Commissioner Tax Commissioner Denise Mitchell is a constitutional officer elected to bill, collect and disburse personal and property taxes and to administer homestead exemptions. Serving also as an agent for the state of Georgia, the tax commissioner registers and titles motor vehicles and disburses associated revenue.

https://www.gwinnetttaxcommissioner.com/home

Gwinnett County: Home - Gwinnett

Attend Gwinnett's annual job fair on February 3. Posted: January 21, 2026 ... Important changes coming to County website. Posted: January 21, 2026. Important ...

https://www.gwinnettcounty.com/FY2026 Budget Update: August 2025 Millage Rate Public Hearings - Gwinnett County Public Schools

Gwinnett County has finalized the 2025 property tax values. The Gwinnett County Board of Education has scheduled three public hearings about the 2025 Millage Rate that will be held at the Instructional Support Center in Suwanee on: A sign-up sheet will be available at the hearings for those wishing to speak.

https://www.gcpsk12.org/about-us/budget-and-financial-information/fy2026-budget-update-august-2025-millage-rate-public-hearings

Property Taxes Lawrenceville, GA

Property Taxes Notice Regarding 2025 Property Tax Bills The City of Lawrenceville would like to inform property owners of a delay in the mailing of this year’s property tax bills. Recent changes to the State of Georgia’s property tax exemption process required us to update our billing system.

https://www.lawrencevillega.org/181/Property-Taxes

Gwinnett County - About - Tax Appeal Search

Tax Appeal Search Tax appeal procedures to the board of equalization are contained in Official Code of Georgia Annotated 48-5-311(e)and 48-5-306 and those wishing to appeal should familiarize themselves with these procedures. Time limitations do apply. The taxpayer or the county board of tax assessors may appeal decisions of the county board of equalization or hearing officer to the superior court of the county in which the property lies.

https://www.gwinnettcourts.com/about/boe-appeal-search

Today, Chairwoman Nicole Love... - Gwinnett County Government Facebook

Today, Chairwoman Nicole Love Hendrickson presented a proposed $2.6 billion budget for fiscal year 2026 to the public and the Board of Commissioners during a briefing. The proposed budget represents a $66 million decrease from 2025’s approved budget. To read more about the 2026 proposed budget and to provide your input, visit GwinnettCounty.com/2026ProposedBudget.

https://www.facebook.com/GwinnettGov/posts/today-chairwoman-nicole-love-hendrickson-presented-a-proposed-26-billion-budget-/1314694070687611/

GSCCCA.org - PT-61 eFiling

the clerks authority Georgia Superior Court Clerks' Cooperative Authority...

https://apps.gsccca.org/pt61efiling/

GCP Training Course Schedules Department of Revenue

- Board of Assessors - Board of Equalization - Tax Commissioner - Training Facilities - Hearing Officer On this page find information for training schedules and facilities for continuing education for county tax officials with the Georgia Certification Program (GCP). Related Links Find course and manual materials.

https://dor.georgia.gov/gcp-training-course-schedules

Property Taxes Lawrenceville, GA

Property Taxes Notice Regarding 2025 Property Tax Bills The City of Lawrenceville would like to inform property owners of a delay in the mailing of this year’s property tax bills. Recent changes to the State of Georgia’s property tax exemption process required us to update our billing system.

https://www.lawrencevillega.org/181/Property-Taxes